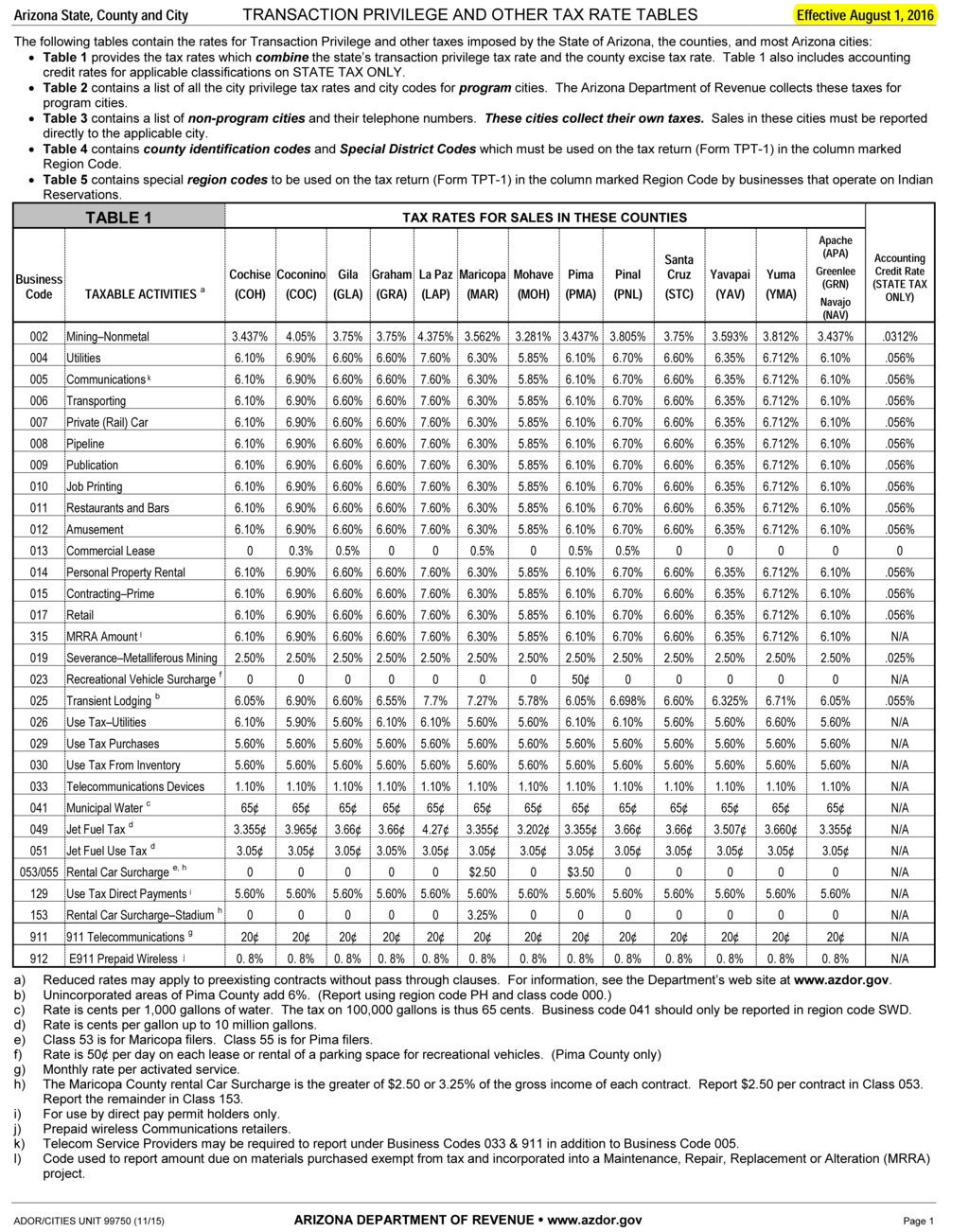

AZ TPT Rates Effective 8.1.2016

August 1, 2016

Research and Development Credit – Can Your Small Business Benefit?

February 22, 2017Nevada passed legislation in 2016 creating a new Commerce Tax on all businesses doing business in NV. The Commerce Tax is based on gross revenue and is calculated using a fiscal period of July 1 through June 30 regardless of the entities normal fiscal year. Everyone doing business or licensed to do business in Nevada must file the form annually by 8/15.

The tax only applies if the business has more than $4,000,000 of NV gross revenue. If gross revenue is less than $4,000,000 a simplified filing is allowed. We know that Nevada is sending out “Welcome” letters to businesses that are licensed there.

Penalties can be assessed for failure to file the return but at this time it appears that penalties are based on tax due so if no tax is due, there will be no penalties. Morrison Clark & Company suggests that you file the required forms even if there is no penalty as the State of Nevada may have other consequences for non-filing that and may result in a termination of your licenses.

If you have any questions concerning the new filing requirement, here is link to the Nevada Department of Taxation or call Morrison, Clark & Company at 480-424-7855 and talk with one of our tax experts.